A local investment club invited me to share my investment story. I reflected and summarized 3 projects with lessons and insights learned. I will be transparent and share both good and bad sides. Hope some part of it will be helpful to you.

“Always take the high road, it’s far less crowded.” – Charlie Munger

The Beginning

After graduation with Master of Actuarial Science, I joined a multinational financial company as an intern in 2012 and was trying to climb the corporate ladder. One year later, I could see where I would end on the ladder when I retire. I didn’t want this predictable destination. But I had no idea what I wanted to do with my life. I felt I was going circles all day long without a purpose.

I started to search for personal finance books and found Robert Kiyosaki’s book <Rich Dad Poor Dad>. This book helped me understand important financial concepts, such as rat race, passive income, asset and liability. This is totally different from the finance theory I learnt from university.

Robert’s books helped me to find my interest. I want to invest in real estate, create passive income and build long term wealth. I started to chat with local realtors and compare different areas of Toronto. After understanding the investment process, my wife and I quickly invested our first rental property in 2013, which was an ordinary house and we rented it to a lovely young family.

To be honest, our knowledge on real estate back then was very limited. We didn’t fully understand the importance of cashflow and only hoped house price would increase. Once renting it out, we realized huge hidden expenses such as vacancy and repairs. Instead of getting positive cashflow, we had to put a portion of salary into the house every month!

Luckily, house price increased and we sold it 2 years later with 300% return on initial invested capital. Despite the gain in the end, it was a very painful 2 years for us because of negative cashflow. We truly realize the importance of positive cashflow, which is the key to financial freedom that we really want.

Airbnb Business

Fast forward to 2017, my wife and I have invested several properties with positive cashflow. However, I couldn’t find positive cashflow properties in Toronto anymore, because house price increased a lot. Without positive cashflow, it was very difficult to apply new mortgages and grow our investment portfolio.

In order to increase cashflow, we decided to acquire an old house in Toronto downtown to operate Airbnb. It was our first time to start a business. We were very excited but nervous at the same time. We set up a 3-tier corporate structure for asset protection and tax benefits.

Two of us did interior design, marketing, logistics, customer service and hired part-time employees for cleaning and repairing. All of these felt real and we were taking step by step towards our financial freedom goal.

It wasn’t all romantic. In order to get the Airbnb ready before the high season, we had to make it move-in ready within one week. We took one week off and worked on it day and night. We assembled about 50 boxes of IKEA furniture and filled 6 shopping carts in Costco!

When it was finally ready to rent, it was actually the beginning of a nightmare. Due to lack of operating experience, we didn’t have good garbage collection process or noise monitoring process. Garbage bags were carried to street curb the afternoon before garbage day. They were all damaged by racoon at night. Garbage was all over the front yard and smelt really bad.

We didn’t know that one guest was hosting a party and yelling in the house until received complaint notices from City of Toronto. One of our neighbors complained to every single department in Toronto city hall one can image: fire department, electrical safety authority, parking permit office and garbage collection department. We received warnings and action items from all those departments.

To be honest, that was a really stressful experience. We eventually solved all those problems and our first-year revenue was more than double of long-term rental. Those problems seemed like end of the world at that time. But when I look back now, those were easy fixes. And I learned valuable experience on serving clients and managing employees.

Legal Conversion

When we were doing well with Airbnb, City of Toronto started to ask feedback on new short-term rental regulation. The new regulation only allows owners to operate in their primary residences. It only allows one property per owner and rent less than 180 nights per year. We realized that Airbnb is not a scalable business when this new regulation comes in effect.

We knew it was not about whether but when the new regulation would come. Airbnb is not a good choice anymore in Toronto and we need to find new ways to create passive income. Therefore, I went to seminars, trainings, read books, and paid mentorship from people who had already done what I wanted to do.

I decided to do legal conversion projects because its business model makes sense. The plan was to acquire a single-family house and convert it into a legal duplex. Rent would double and house value would increase after the conversion. What’s even better, we can refinance from bank after renovation and get renovation cost back.

The challenge was finding a right property and a right team to implement the plan. It took me 4 months to find a property that meets zoning requirements, building codes, city by-law, with good location and good price. Then I worked with an architect and an engineer to create a new floor plan. We revised 8 versions to optimize layout, functionality and cost. At the meantime, I interviewed more than 10 contractors and finally found an excellent one.

As you can imagine, there were countless surprises during building permit application and construction. But we managed to finish the construction on time and on budget. Even better, we received more than 30 rental applications and signed leases before construction finished. Once they moved in, we refinanced from bank and got all construction cost back. The rent almost doubled comparing to single-family house, and cashflow was amazing.

Quit Job

The legal conversion project felt like a milestone, but I knew I can’t stop here. I was still in a rat race and doing routine work from 9 to 5. At that time, I was an Actuary Director in the same financial company with 6 figure salary. But that job didn’t give me fulfillment. More importantly, I knew that job could not lead to where I want to be.

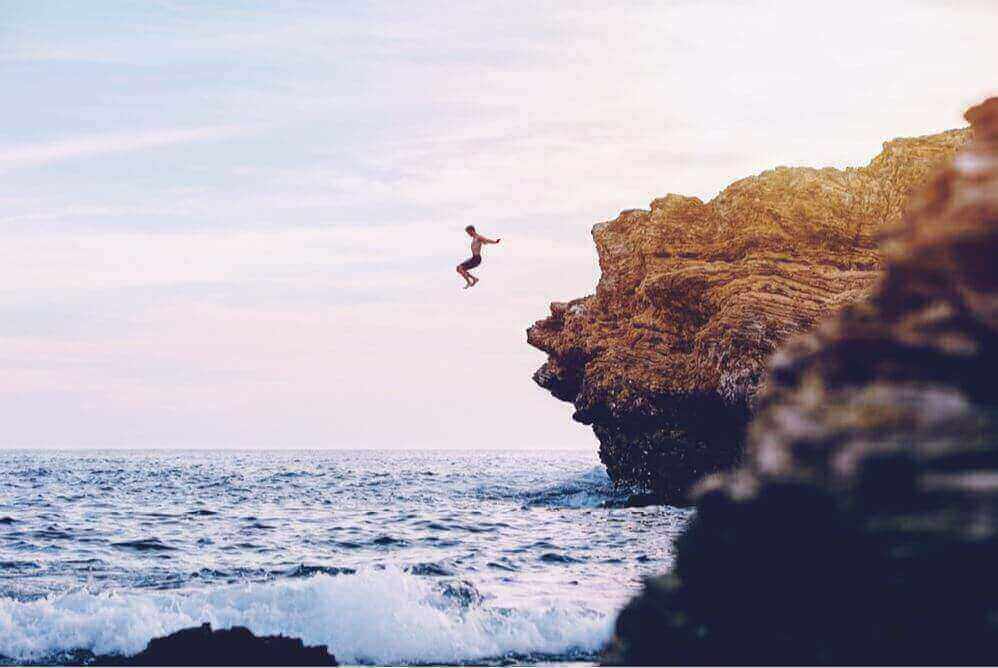

As you can tell, real estate investment has gradually become my passion. I wasn’t pursing my passion and spending time on work I love. I thought about quitting the job but it was very difficult to overcome the fear. It felt liking jumping off a big cliff and hoping I can survive.

Christopher Columbus once said: “You will never cross the ocean until you have the courage to lose sight of the shore.” I love that quote and asked myself, “What worst case can happen?”

Even in the worst case, I believe we still can find food and a place to live. My wife is very supportive and real estate investment is her passion too. So I decided to quit and start my own investment company.

It was pretty scary at that time, but looking back it was one of the best decisions I ever made. The minute I quit, I could stop spending time on things that didn’t interest me, and began working on things that I truly enjoy.

200-unit Multifamily

Although I was trained as an actuary to be conservative and manage risks, I decided to go big or go home. I always wanted to invest in big multifamily properties as Robert Kiyosaki did. But I didn’t know how to acquire big properties in Toronto.

How should I start? I kept this question in mind and did my best to find an answer. I read all books I can find, listen podcasts, attend seminars/trainings that are related to multifamily. Luckily, I met an investor in a local seminar who invested 40+ multifamily properties with 7,000+ units in Atlanta.

My wife and I flew to Atlanta to meet him, he was so kind and had two lunches with us to share his investment experience. He even toured us in several of his multifamily properties. That was a truly eye-opening moment for us.

I’m forever grateful of him and I’m willing to help others like he helped me. He suggested me to compare US and Canada real estate markets, because he invested houses in Montreal for 20 years before investing in Atlanta.

Therefore, I visited several US cities and realized US has better investment returns, better financing terms, better tax rules and better tenancy laws. It was an easy decision for me to invest in the US. The next question was which part of the US. I researched all US states on economy growth, population/job growth, tax rules, tenancy laws, criminal rate, house price, rent growth, local developments and so on.

Based on research results, I chose Texas as my first target market. Since Dallas is the largest city in Texas with 7.5 million population, I thought it might be easier to find deals and business partners there.

But there was another problem. I didn’t know anyone who was living in Dallas. In this business, it’s not only what you know but also who you know matters. Therefore, I joined two investment clubs in Dallas that focus on multifamily to learn and meet new people.

I was living in Toronto and flew to Dallas almost every month to search for great deals and business partners. In order to accelerate progress, I lived in Dallas for one month. After reviewing more than 70 deals and meeting hundreds of people, I finally found my business partners and we acquired a 200-unit multifamily property in Dallas.

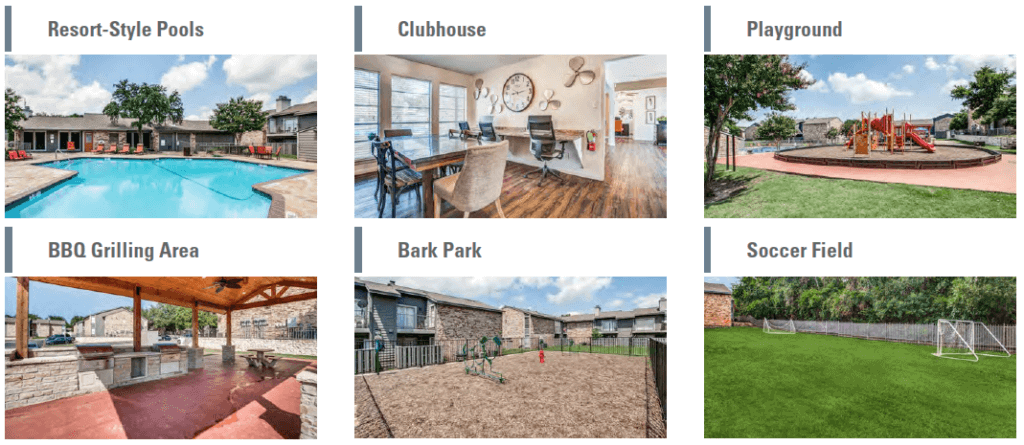

This property is located in a nice Class B neighborhood that is 20 mins drive from Dallas downtown. It’s close to shopping center, highway, schools, parks, community center and lakes. It was an off-market deal with great price. We were the only group who toured the property and submitted an offer.

That was another milestone in my investment journey. I truly appreciate all the support from family, friends and business partners. I can’t get here without your support.

I don’t know where this investment journey will lead me to. But I do know that I will always take the high road, because it’s far less crowded.