Acquired more than 2900 Units

AUM over USD

$360 Million

12 Multifamily Properties

Total Equity Invested Over USD $120 Million

About Our Company

Our company has been investing in real estate since 2013. We started from investing single family home in Great Toronto Area. We are currently focusing on the US multifamily and have acquired over 2900 Multifamily units in Texas. Total asset acquired has reached $360 Million.

Mission

Help investors create passive income and achieve financial freedom.

Help more people increase financial IQ and better enjoy life.

Vision

Become the most client centric general partner in the universe.

Our Happy Investors

“The investment experience with Oak Real Estate Investment has been the best and least stressful we had so far with great returns! ” – Janice

Value

Our value guide us in everything we do.

Integrity

Always do what is right, not what is easy.

Value

Consistently provide value to our clients.

Passion

Truly love and excited about what we do.

Excellence

Always take the high road, keep learning and improving.

Our Investment Strategy

Balance Between Cash Flow and Appreciation

Market Selection

We have a set of very strict criteria when it comes to market selection. It covers various aspects from fundamental economics to local real estate market, which will be discussed in later sections. All the criteria ensure ongoing positive cash flow and possible future appreciation.

Property Acquisition

We spend a significant amount of time searching and analyzing great deals. Our actuarial background has helped us in financial modeling and analyzing deals. All assumptions that go into financial projections are conservative, and stress testing are performed on key assumptions.

Add Value

We work with professional property management company and construction company to increase value of the property. As an asset manager, we closely monitor their performance, and make sure everything is carried out according to business plan.

Cash Out

Once we have successfully execute the business plan, we will sell the asset to realize profit for our investors. We work with top level professional real estate brokers in order to achieve best price.

How We Select Market?

We only choose markets with high potential

Population Growth

We check historical population growth, and only pick cities with the top influx of people. This is demand side of rental market and is also the fundamental driver of rent and price growth.

Job Growth

To ensure the market has solid employment, we look at a few metrics including unemployment rate, job growth, industry diversification. We are particularly interested in markets that are consistently adding high-paying jobs in various industries.

Economic Diversification

We perform extensive research and analysis on the local economy. We look for markets with more than four supporting industries. We avoid the markets with single supporting industry because its cycle will negatively impact rents and house price.

Landlord Friendly

We only invest in markets that are landlord friendly. Eviction process, landlord & tenant rights, rent control rules and property tax are all critical factors for successful real estate investment.

What to Expect from Us

Treat clients the way we want to be treated

Stable Cash Flow

Regular cash distribution will be made to our passive investors once the multifamily asset is stabilized.

Long Term Appreciation

Through professional property management and strategical rehab, we force property value to increase and therefore bring excellent returns when we sell.

3-5 Year Exit

Our target is to execute business plan, improve and sell the property in 3-5 years. This means that our investors will have initial capital and profit back in 3-5 years.

Excellent Communication

Warren Buffett said he treats his investors the way he wants to be treated. We strive to do the same. Therefore, we will always put our investors interest first and always be there when you need any help.

Our Happy Investors

Our Portfolio

Esencia

Location: DFW, Texas

Type of Property: Multifamily

No. of Units: 200

Year Acquired: 2020

Year Built: 1981

McCallum Glen

Location: DFW, Texas

Type of Property: Multifamily

No. of Units: 275

Year Acquired: 2020

Year Built: 1985

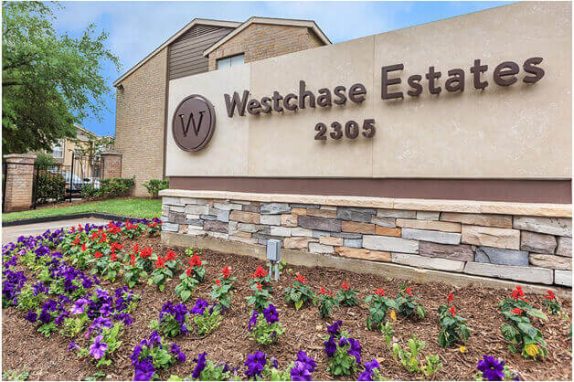

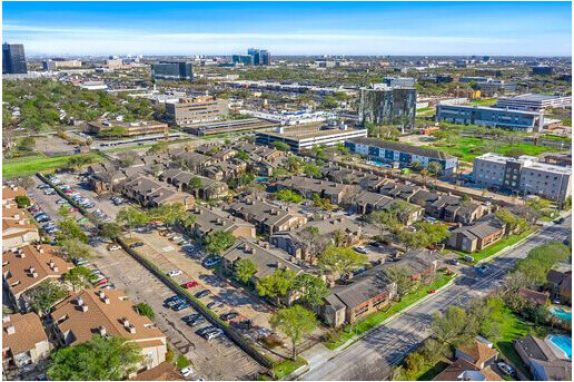

The Estates at Westchase

Location: Houston, Texas

Type of Property: Multifamily

No. of Units: 307

Year Acquired: 2021

Year Built: 1980

Our Portfolio

Ranch at Sienna

Location: Houston, Texas

Type of Property: Multi-Family, Class A

No. of Units: 312

Year Acquired: 2022

Year Built: 2016

Sam Rayburn Townhomes

Location: DFW, Texas

Type of Property: New Construction Build-to-Rent, Class A

No. of Units: 118

Year Acquired: 2023

Year Built: 1984

Esencia

Location: DFW, Texas

Type of Property: Multi-Family

No. of Units: 200

Year Acquired: 2022

Year Built: 1981

Our Founder

Albert Shi

Albert Shi is Founder and Chief Executive Officer of Oak Real Estate Investment. He has been investing in real estate since 2013 and is currently focusing on Multifamily investment. Before founding his own company, Albert previously was an Actuary Director at a Fortune 500 financial company and was responsible for risk management of USD $1Billion investment portfolio.

Albert has very strict criteria when selecting investment projects. He usually selects one project out of over 100 potential projects. His investors’ referral rate and reinvestment rate are over 60%.

Albert enjoys sharing his knowledge with others. He has been sharing industry news and investment knowledge in his WeChat group for over 2 years, with over 100,000 words count.

Daisy Wan

Daisy Wan is Co-Founder and Chief Financial Officer of Oak Real Estate Investment. She has been investing in real estate since 2013 and is currently focusing on Multifamily investment. Before founding her own company, Daisy previously served as an Actuary Director at a Fortune 500 insurance company.

Daisy’s expertise is financial analysis. In addition to her background as an Actuary, she is very detail-oriented by nature. She is very familiar with every single income and expenses for the projects.

Our Happy Investors

“With trust and confidence in Albert’s capability, professional experiences and extensive knowledge, I invested in two of his projects. The investment is generating a great return, and he can be reached at any time when I have questions.” – Leo

Our Blog

Our Happy Investors

“I’ve been receiving quarterly distribution as promised and on time. And also receiving monthly email from Albert showing the updated income and expenses. The communication is smooth and transparent. I’d love to invest more or partnering with Albert.” – Iris