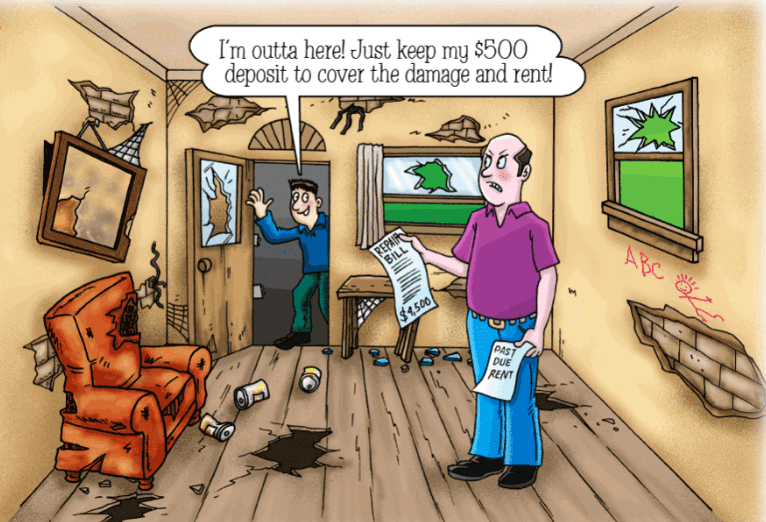

Bad tenants will stop paying rents, have endless unreasonable requests or cause damage to our investment properties. It can create too much stress and frustration on new landlords. The best way to prevent that is properly screening tenants before signing lease agreement.

I will share my tenant screening process, which has been continuously improved since 2013. This process helped me found good tenants and none of them skipped rent or caused damage.

1. Application Form

Application form is our starting point of tenant screening. It shows that potential tenant is serious about renting this property. Since there are many applicants, we don’t want to spend too much time on tenants who are not serious.

It also discloses their basic information such as income, credit score, occupation, number of people, move in date, pet, previous address, phone number and so on. This basic information can help us make a quick decision on whether we want to continue the process or skip this applicant.

Once we decide to continue the process, we can ask for following 4 supporting documents. These documents will help verify what they write in application form. The key point here is “Trust but Verify”.

2. Income Proof

Income proof document is the most important thing to verify. If they don’t make enough money, there is a high probability they can’t pay rents on time. I usually request monthly household income to be 3-4 times of monthly rent. The most common documents for income proof are pay slip, bank statement and tax return file. We can cross check several income documents if one document seems being modified.

3. Credit Report

Credit reports give us tons of information about potential tenants. I not only check their credit score but also check their loans, number of late payments, bankruptcy record, collection history and so on. I usually require credit score higher than 650 and no large balance on visa cards/loans. Too many times of late payment and bankruptcy record are red flags too.

Equifax and TransUnion are the two most common credit report companies. We need to pay a small amount fee to buy reports from them. Some third-party companies like Naborly also provides free service to check tenant credit report.

4. Employment Verification

I ask for an employment letter to show tenant’s company name, address, contact info, occupation, salary, working years and so on. It’s very helpful to call their employer to verify this information and learn more about this tenant.

In order to know whether tenants give us their friends or employers phone number, we can ask tenants several detailed specific questions. Then I write down their answers and ask the same questions to their employers. Since these questions are specific about their work, it’s harder to collude with friends.

5. Landlord Reference

Talking to their landlords and learning how they behave in the past is very helpful too. We should not only pay attention to what landlords said but also what they did not say. It’s also better talking with their previous landlord instead of current landlord. This is because current landlord may hate the tenants and want them move out immediately, so he may hide truth from you.

A Few Final Words

Dealing with tenants may feel annoying or scary at the first time. Carefully screening tenants can eliminate most troubles along the way. Investing real estate is like running a business. It’s always helpful to have a system for business. Tenants screening is definitely an important piece of that system.

Welcome feedback and interested topics to improve this knowledge share group.