COVID-19 already created unprecedented volatility in the economy. I have been thinking how to navigate during this risky period and manage investment risk. Therefore, I did some research and want to share some insights on investment risk with you.

Investment Risk

What is investment risk and how can we measure it?

One common way to measure risk is using volatility, which is very popular among academics and fund managers. However, Charlie Munger (the long-time partner of Warren Buffett) believes that it doesn’t make any sense to use volatility as a measure of risk.

Why? Because he believes volatility often has nothing to do with investment return. Some great businesses have very volatile quarterly results due to expected high/low reasons. On the other hand, some terrible businesses have very steady but awful results.

For example, See’s Candy is one of the best investments done by Buffett. Its total investment return is more than 8000% since 1972, or more than 160% per year. However, See’s Candy still has obvious seasonality and experiences 2 quarters of loss and 2 quarters of profit every year (its high season is Christmas). Volatility is absolutely not equal to risk.

Charlie declares that investment risk to Berkshire Hathaway is: 1) The risk of permanent loss of capital, or 2) The risk of inadequate return.

Managing Investment Risk

Many people believe that higher risk always goes with higher return. That’s true in most cases. But is it feasible to be risk averse and achieve awesome investment return at the same time?

Absolutely yes!

Berkshire is a perfect example. Without any doubt, it is one of the greatest investment companies in the world. It has weathered numerous recessions while providing shareholders superior long-term returns.

So how does Berkshire manage its investment risk? – They are extremely risk averse with double layering protection. At the first layer, they behave in such a way that no rational person is going to worry about their credit. Therefore, they are able to get plenty of low interest loan when needed.

You may ask – what if the world suddenly don’t like their credit and stop lending? The answer is – they don’t even care! They don’t care because they have so much liquidity (Berkshire has about USD$120 billion cash, or about 15% of its balance sheet when this article is written).

This double layering protection is part of the culture in Berkshire. It makes Berkshire much more disaster-resistant than most other companies, and survive the last in almost any type of disaster.

I totally agree with Stephen Schwarzman’s (Blackstone co-founder) point “There are no brave old people in finance. Because if you’re brave, you mostly get destroyed in your 30s and 40s. If you make it to your 50s and 60s and you’re still prospering, you have a very good sense of how to avoid problems and when to be conservative or aggressive with your investments.”

Risk from High Price

“Price is what you pay. Value is what you get.” – Warren Buffett

Risk is usually from the high price at which we buy an asset. The higher the price we pay, the greater risk that we will experience a loss of capital.

Before we invest an asset, if its price drops, risk goes down, not up. Buffett put it this way: “I’m going to buy burgers the rest of my life. When burgers go down in price, we sing the Halleujah. When burgers go up, we weep.”

Risk is Opportunity

I’m a Fellow of the Society of Actuaries (SOA). Actuaries are professionals who specialize in analyzing risks, measuring risks and finding the optimal way to mitigate risks. The famous SOA slogan is “Risk is Opportunity”.

Insurance companies get paid because there are risks people want to avoid. If the world was free of risks, insurance companies couldn’t survive anymore. Insurance companies are able to create opportunities from risks because they have specific expertise in analyzing and mitigating risks. That’s same for investors, we also need specific expertise to turn investment risks into opportunities.

What can we learn from Berkshire when investing multifamily?

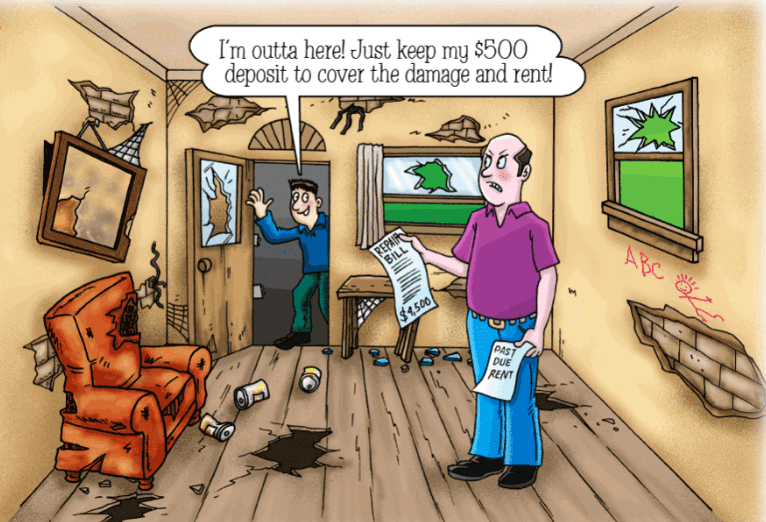

Always be prepared for the worst scenario and hit big when great opportunities appear. This is a survivor mindset, and when it comes to investing multifamily, it could be

- Having a cap on loan-to-value, or

- Having enough liquidity to survive X months without rental income, or

- Using conservative projection assumptions

This list could go on forever and vary greatly by different investors. However, the key is once we have determined our risk limit, never breach it, no matter what other people are doing.

The last survivor wins : )