Selecting right market is always the MOST important decision in real estate investment. We can physically improve an investment property, but we can’t change its location.

It feels overwhelming when selecting a market because too many factors are in play. I will share our criteria and insights for market selection.

Population Growth

Population growth is an extremely important driver for higher rent and home price. In the end, everyone needs a place to live. We usually invest in affordable rental properties instead of luxury properties.

Our target tenants are average working-class people who need a place to live but can’t afford owning a home. We call this “Rigid Demand” because it’s very stable and predictable.

Population growth is not evenly distributed. Some cities attract tons of people and some cities lose people every year. For example, population growth in Ontario is about 200,000 per year. Texas is 500,000 (Top 1 in US). Florida is 350,000. On the other hand, New York State and Illinois State population are dropping.

Job Growth

People tend to move to cities that offer jobs. We prefer investing in markets with strong economic growth and diversified economy. GDP growth, new company headquarters, new infrastructure projects and enormous transportation are signs of strong economic growth.

Diversified economy usually has four or more supporting industries. We tend to stay away from cities only supported by single industry, such as Calgary (oil industry) and Detroit (auto industry). One down cycle of that industry will cut significant amount of jobs and drag down home price.

Demographics

Rental vacancy rate and median rent are useful indicators of rental market trend. We also analyze median household income to understand whether tenants can support future rent growth.

Age distribution can tell us what type of rental properties are popular in this area. For example, increase of certain age group can predict property types that have most demand.

Tax Laws

The US Tax Cuts and Jobs Act (2017), made major changes on Bonus Depreciation. Bonus depreciation is a tax incentive that allows business owner to immediately deduct a large percentage of purchase price of eligible assets.

For example, one multifamily property with purchase price $10 million, owner is allowed to deduct about $3 million depreciation in year 1 (usually 20-40% of purchase price depends on the property). If owner’s net income is $500k per year, it means the owner doesn’t need to pay income tax for 6 years!

Different provinces have very different tax laws. It has huge impact on landlords and often overlooked. For example, Texas has No Personal Income Tax.

Corporate income tax in Texas is extremely low compared to other states. Businesses in Texas are taxed at the rate of 1% or less. Maybe that’s the reason why 1,800 companies left California and most made Texas their destination in 2019.

Tax law is like a treasury map. It has tons of tax incentives for people who understand them. That’s why Robert Kiyosaki and Donald Trump make billions of dollars income every year and legally pay zero tax!

Tenancy Laws

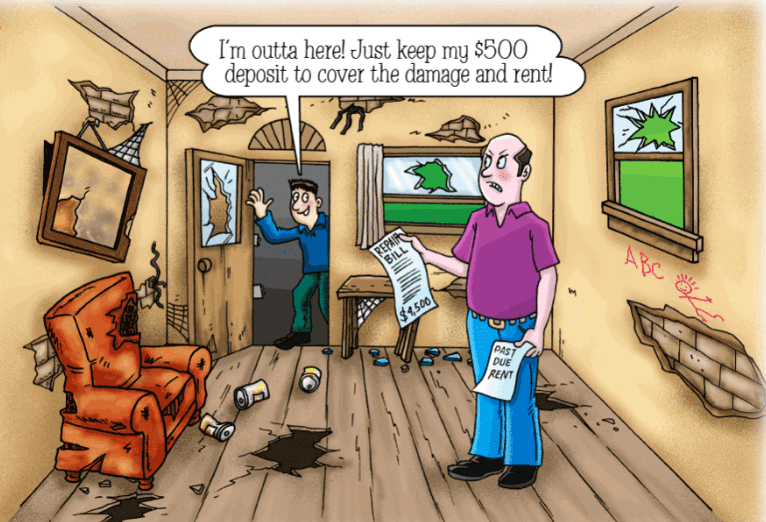

Tenant issue is the number one factor that affects landlords emotionally. Some markets are heaven and some are hell for landlords. Many new landlords are struggling with tenant complaints and property repairs.

Examples of tenant-friendly markets are Ontario, California and New York State. In contrast, Texas, Georgia, Arizona and Florida are landlord-friendly, which are red states supporting Republican Party. That’s why we only invest in red states.

Here is a comparison between tenant-friendly and landlord-friendly markets.

| Tenant-Friendly | Landlord-Friendly | |

| Rent Increase | Has annual limit (Ontario about 2%) | No Limit |

| Eviction Process | Several months | Few weeks |

| Renovation | Need tenant’s permission and compensation | Landlord’s right to renovate |

| Renew Lease | Tenant can renew lease forever | Landlord decide whether renew |

| Deposit Amount | One month rent | Landlord decide deposit |