How can we recognize market tops and bottoms?

Some patterns recur regularly in our environment, influencing our lives. For example, the spring always follows the winter. The winter is colder than the summer. Thus, we can anticipate what will happen and plan different activities in different reasons. Most of us follow the patterns to make everyday life easier.

Market also has patterns and usually referred as market cycle. Understanding market cycle helps us anticipate and plan ahead financially. I recently read the autobiography of Stephen Schwarzman (co-found of The Blackstone Group). Stephen argues the success of any investment depends largely on where we are in the cycle when we make it. I will share his views about market cycle.

Market Tops and Bottoms

Cycles are ultimately powered by all types of supply and demand. By understanding and quantifying them, we can be well positioned to identify how close we are to a market top or bottom.

Market tops are relatively easy to recognize with 3 characteristics:

- Buyers generally become overconfident and almost always believe “this time is different.”

- Always a surplus of cheap debt capital to finance acquisitions and investments in a hot market. Leverage levels escalate compared to historical averages.

- Another indicator is the number of people you know start getting rich. A rising tide can make it easy for individuals without any strategy or process to make money accidentally.

Market bottoms can be difficult to detect as the economy weakens. Most investors buy too early and underestimate severity of recessions. They generally don’t have confidence or discipline to wait until a cycle fully plays out.

Timing the bottom of a cycle isn’t easy. And it’s often a bad idea to try it, because it takes time for an economy to emerge from a recession. Even when a market starts turning around, it also takes time for asset values to recover. The way to avoid this is to invest only when values have recovered at least 10 percent from their lows. It’s better to give up that first 10 percent to ensure that we are buying at the right time.

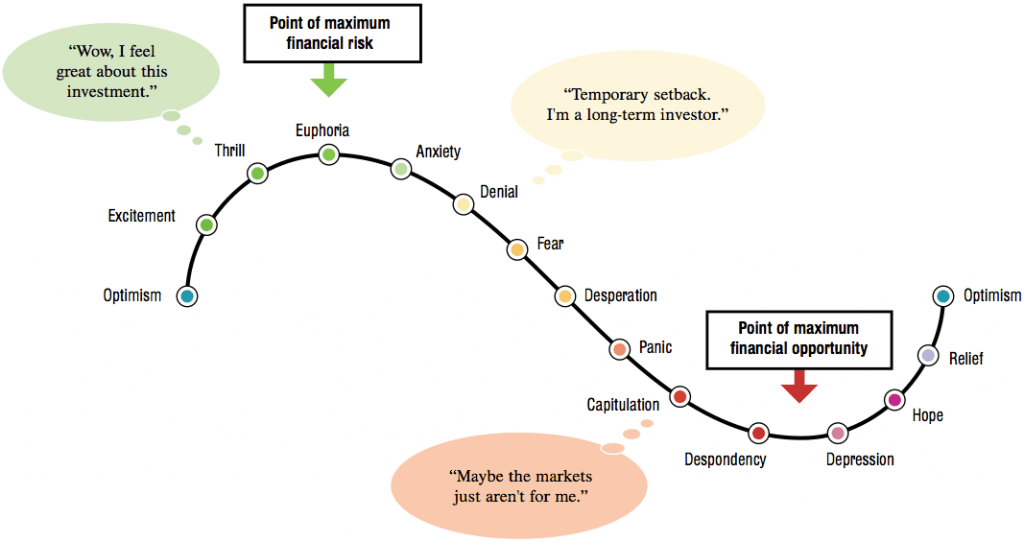

Psychological Comfort

While most investors say they are interested in making money, they are actually interested in psychological comfort. They would rather be part of the herd, even when the herd is losing money.

These investors tend not to invest aggressively near market bottoms, but instead to invest at market tops. Even this makes little sense, they like the psychological comfort. The higher prices go, the more investors convince themselves that prices will continue appreciating.

Understand The Value

Warren Buffett once said, “If you’re an investor, you’re looking on what the asset is going to do; If you’re a speculator, you’re focusing on what the price is going to do, and that’s not our game.” He believes that an investment operation is promising safety of principal and an adequate return after thorough analysis. Buffett prices assets based on their values now rather making prediction about their prices in the future.