Why is purchasing power different from money in long-term?

Why We Invest

Warren Buffett says, “Investing is laying out a dollar of purchasing power and getting more back in the future.” Purchasing power is more important than money. Here is why purchasing power and money are different from long-term perspective.

For example, US dollar lost 93% purchasing power in past 100 years. In other words, $100 US dollar in 1919 is equivalent to $1,430 in 2019. If one person makes $100k per year and lives a comfortable life now. Let’s assume inflation 3% per year, 30 years later when he/she retires, only has $100k*(1-3%) ^30 = $40k purchasing power.

What’s even worse. Most companies pension plans changed from Defined Benefits (DB) to Defined Contribution (DC). DB plan guaranties how much money you get AFTER you retire. On the other hand, DC plan guaranties how much money your company contribute BEFORE you retire. For DC plan, there is no guarantee on how much money you will get after retiring.

Therefore, my wife and I decided not to depend on pension plan, and we must control our own financial situation. We get ourselves educated and are investing to get more purchasing power for long term.

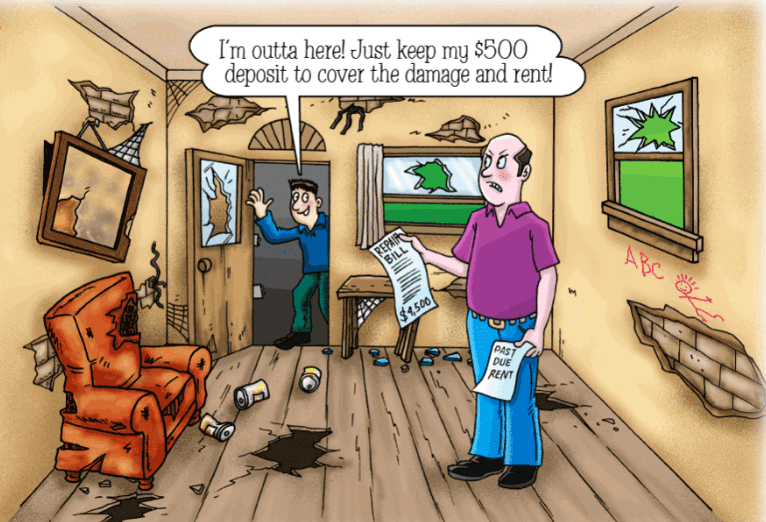

Passive Income and Financial Free

There are two types of income: Active vs Passive. Active income requires your time and energy, such as salary. Passive income makes you money even when you sleep. For example, rental income, dividend, bond coupon, loyalty, copyright, patent and etc.

Financial Free means your monthly passive income larger than living expense. Most people don’t track their monthly living expense. One good approximation of living expense is your salary. “If you don’t find a way to make money while you sleep, you will work till you die” – Warren Buffett.

We are creating more passive income, so that we have freedom to choose what we do, and who we spend time with.

Everyone has limited time. Our mentor always says, “Time is Everything”. And passive income enables us to spend more time on work and people we love.

My biggest motivation is knowing my time is limited. I installed a countdown app in my phone, and it shows how many days I left (assuming average age 80 years). Not many days left if you do your own calculation. Life is short and spend it on what we love!